Confusing ERISA Requirements Are Solved With A Wrap Plan

November 02, 2016

What is ERISA and why is it so confusing?

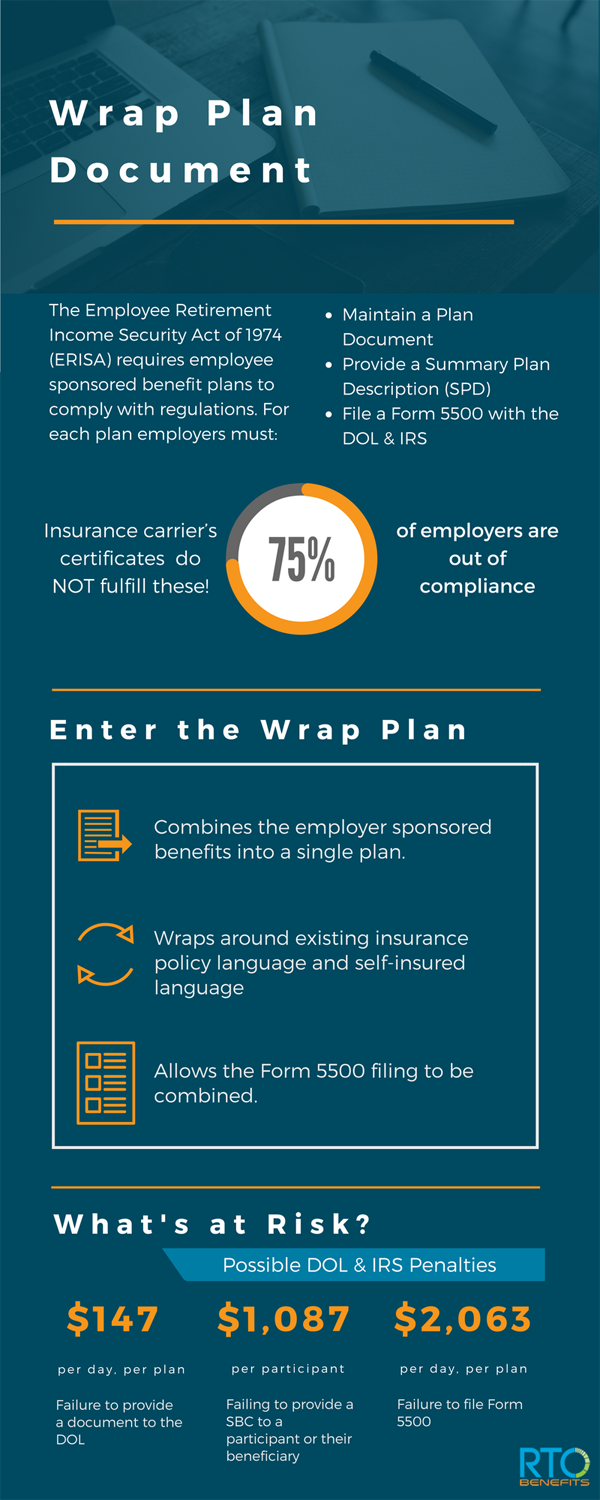

ERISA stands for the Employee Retirement Income Security Act of 1974 and is a federal law which sets minimum standards for employee benefit plans. These regulations apply to virtually all Plan Administrators and Employers* who offer sponsored benefits, regardless of their size or number of participants.

There is a long list of ERISA required language and most "health and welfare" benefit plans must comply with these specific requirements. Requirements Include:

- Employers must maintain, for each benefit plan, a written Plan Document that includes specific elements required by ERISA.

- Employers must provide a Summary Plan Description (SPD) that explains key terms and conditions to each participant.

- The Form 5500 Reporting needs to be filed with the DOL and IRS for each benefit plan.

Insurance carrier's certificates most often do NOT fulfill these requirements, which leaves many employers at risk of being found out of compliance with ERISA.

The Solution = The Wrap Plan

An excellent solution for employers is a Wrap Plan. A Wrap Plan combines the employer-sponsored benefits into a single plan. Essentially it "wraps" around existing insurance policy language and self-insured language, to create a fully compliant Plan Document and SPD.

Another benefit of the Wrap Plan is it allows the Form 5500 filing to be combined, regardless of when the different benefit plans renew.

What are the risks?

Penalty Fees for failing to file the Form 5500 or failure to provide a Plan Document to a participant, State Agency or the DOL, have risen significantly:

- Failing to provide a document to the DOL can be as high as $147 per day, per plan

- Failing to provide a Summary of Benefits & Coverage (SBC) to a participant or their beneficiary can be as high as $1,087, per participant

- Failure to file Form 5500* penalties are up to $2,063 per day, per plan

Where to start?

While there are several offerings available to create Wrap documents many are time-consuming and require manual updates. They can also be very expensive. RTO Benefit's EnsuredCompliance provides a solution to reduce the hours required to meet the ERISA requirements for the Wrap Document. It gives the Employer piece of mind that the document(s) are stored, easy to access, simple to update and formatted to provide a quick response to a participant request or DOL Audit. An audit can come about unexpectedly and having your Plan Documents easily accessible is one less concern.

* Most governmental agencies and churches are exempt from ERISA.

** Currently Form 5500 is required to be filed annually if any benefit plan has a minimum of 100 participants

Wrap Plan Document Infographic